Last updated on 2025-07-15

Program Overview

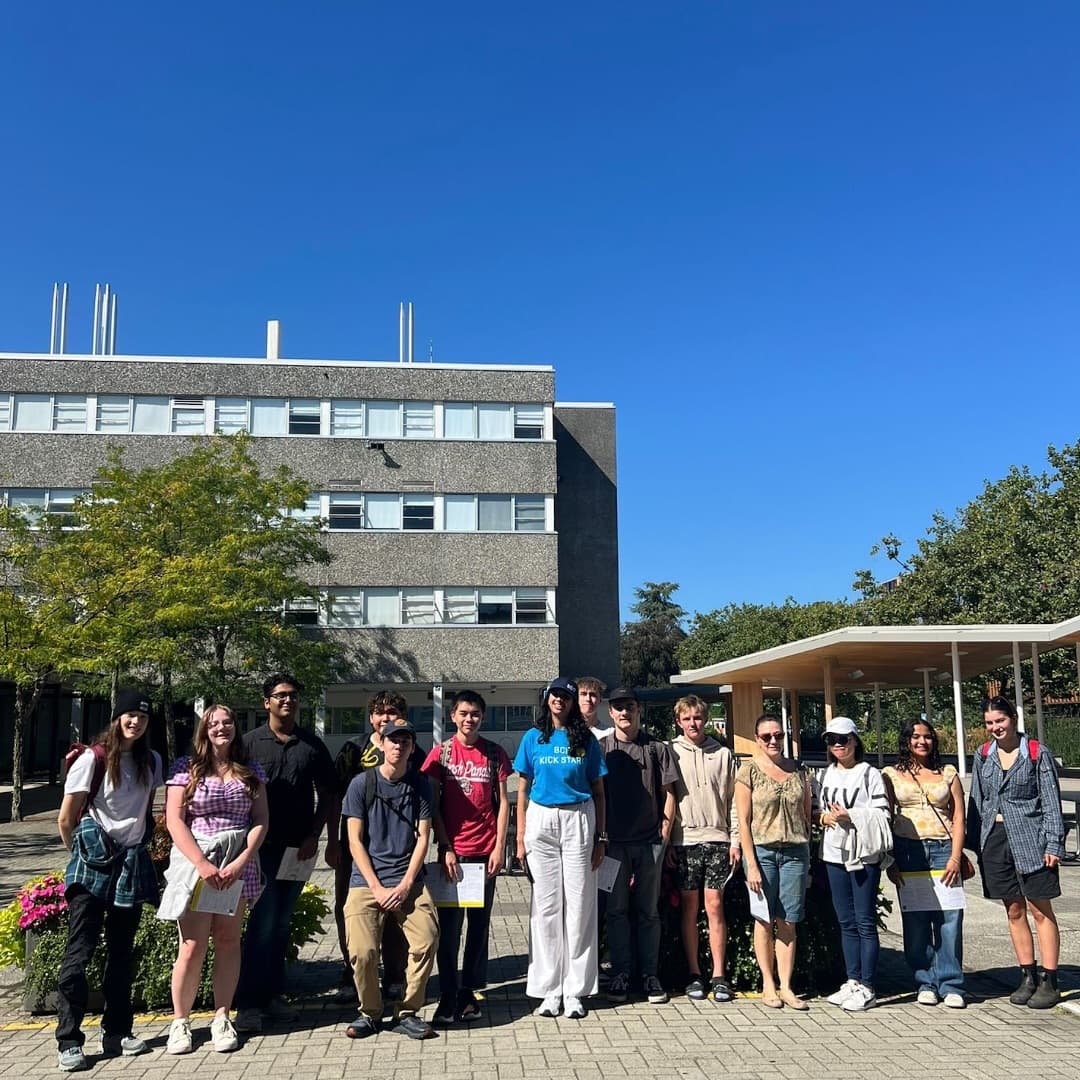

The General Insurance and Risk Management Diploma at BCIT is designed to equip students with the essential skills and knowledge needed to thrive in the insurance industry. This full-time program spans two years and is delivered in person at the Burnaby and Downtown Vancouver campuses. Students will gain practical experience in various aspects of insurance, including claims investigation, marketing, and risk management. The program is closely aligned with industry needs, ensuring that graduates are well-prepared to enter the workforce. With a focus on real-world applications, students will have opportunities to network with industry professionals and participate in events that enhance their learning experience.

Program Structure

The General Insurance and Risk Management Diploma program is structured to provide a comprehensive education over a two-year period. Key details include:

- Program Length: 2 years

- Credits: Total of 114.5 credits

- Delivery Format: In-person classes

- Work Placement: 40-hour work placement included

- Start Dates: September each year

This program also offers students the chance to qualify for a level 1 licensed broker status after completing two CIP courses in their first year. Graduates are eligible for a level 2 broker's license and an independent adjuster's license upon completion. The curriculum is designed to prepare students for the Chartered Insurance Professional (CIP) designation, with eight out of ten required courses completed during their studies.

Featured Experiences

- Hands-on experience through a 40-hour work placement in the insurance industry.

- Networking opportunities with industry professionals through various events.

- Preparation to write the three GRMI national exams before graduation.

- Access to industry events that enhance learning and professional connections.

- 100% job placement rate within four months of graduation.

Career Options

Graduates of the General Insurance and Risk Management Diploma can pursue a variety of career paths in Canada, including:

- Insurance Sales Representative: Responsible for selling insurance policies and providing clients with information about coverage options.

- Insurance Agent or Broker: Acts as an intermediary between clients and insurance companies, helping clients find the best policies for their needs.

- Insurance Adjuster: Investigates insurance claims to determine the extent of the insurer's liability and ensures fair settlements.

- Claims Examiner: Reviews and processes insurance claims, ensuring compliance with policy terms and conditions.

- Property Underwriter: Evaluates risks and determines coverage terms for property insurance policies.

- Risk Analyst: Analyzes potential risks and develops strategies to mitigate them for businesses and organizations.

- Risk Manager: Oversees risk management strategies within an organization, ensuring compliance and minimizing potential losses.

DISCLAIMER: The information above is subject to change. For the latest updates, please contact LOA Portal's advisors.

Visit British Columbia Institute of Technology (BCIT) official website