Last updated on 2025-07-15

Program Overview

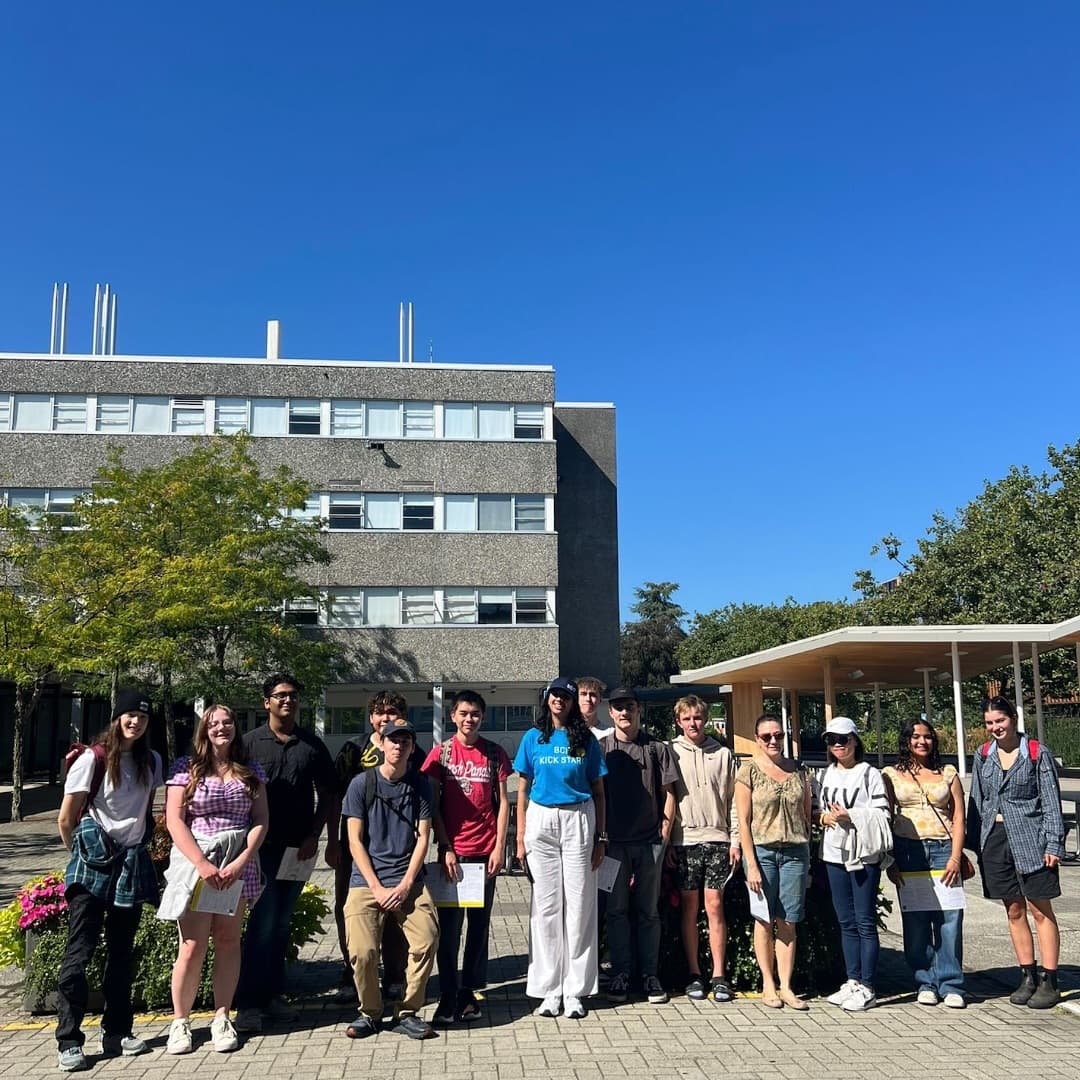

The BCIT Accounting Diploma program is designed to provide students with a solid foundation in accounting principles, preparing them for a successful career in business and accounting. This full-time program spans two years and is delivered in a blended format, combining both in-person and online learning. Students will benefit from experienced industry instructors and gain valuable insights into the role of accounting as the backbone of businesses. Graduates will be well-prepared to pursue their CPA designation and can complete their bachelor’s degree in just one additional year after graduation. The program starts in September and is located at the Burnaby campus.

Program Structure

The Accounting Diploma program at BCIT is structured as follows:

- Program Length: 2 years (full-time)

- Credits: Total of 111 credits

- Delivery Format: Blended (partly on campus and partly online)

- Start Dates: September each year

- Campus: Burnaby

This program offers a comprehensive curriculum that prepares students for various accounting roles. Additionally, students have the option to pursue further education, completing a bachelor’s degree in just one year after graduation. The program is designed to equip students with the necessary skills to achieve their CPA designation, making it an excellent choice for those looking to advance their careers in accounting.

Featured Experiences

- Blended learning format that combines in-person and online classes.

- Experienced industry instructors providing real-world insights.

- Opportunities for international study to gain a global perspective.

- Preparation for CPA designation, enhancing career prospects.

- Access to a strong network of alumni and industry connections.

Career Options

Graduates of the Accounting Diploma program can pursue a variety of career paths in Canada, including:

- Accounting Clerk: Responsible for maintaining financial records, processing invoices, and assisting with bookkeeping tasks.

- Internal Auditor: Evaluates the effectiveness of an organization’s internal controls, risk management, and governance processes.

- Staff Accountant: Prepares financial statements, assists with tax preparation, and ensures compliance with accounting regulations.

- Budget Analyst: Analyzes budget proposals, monitors spending, and helps organizations allocate resources effectively.

- Financial Analyst: Evaluates financial data, prepares reports, and provides insights to support business decisions and strategies.

These roles provide a strong foundation for further advancement in the accounting field, with many graduates eventually pursuing senior positions or specialized roles within the industry.

DISCLAIMER: The information above is subject to change. For the latest updates, please contact LOA Portal's advisors.

Visit British Columbia Institute of Technology (BCIT) official website