Last updated on 2025-05-14

Program Overview

The Bachelor of Science with Major in Mathematics and Finance is designed to equip students with a robust education in mathematics, finance, economics, and actuarial science. This program emphasizes the application of mathematical and statistical techniques to analyze financial products and manage financial risks effectively. Graduates will emerge with the skills necessary to navigate the complexities of the financial world, making them valuable assets in various industries.

Program Structure

The Bachelor of Science with Major in Mathematics and Finance offers a flexible and customizable educational experience. The program is structured to allow students to tailor their studies according to their interests. Key features of the program include:

- Program Length: Typically spans over four years.

- Options for an optional minor or double major, providing a breadth of study across various disciplines.

- Students can choose from over 60 subjects for their minor, including offerings from the Faculty of Arts, Native Studies, Business, and Agricultural, Life & Environmental Sciences.

- Opportunity to engage in undergraduate research and hands-on learning experiences.

This structure not only allows for a comprehensive understanding of mathematics and finance but also encourages students to explore additional areas of interest.

Featured Experiences

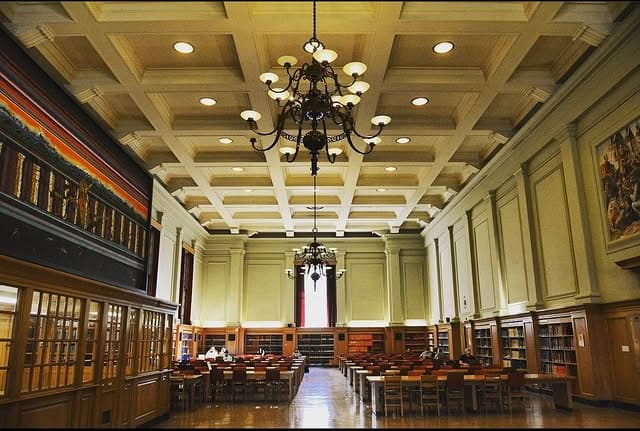

- Hands-on learning opportunities through practical applications of mathematical and financial theories.

- Access to state-of-the-art teaching and learning facilities.

- Engagement in undergraduate research projects under the guidance of leading faculty members.

- Possibility of participating in co-op programs or internships to gain real-world experience.

- Collaboration with industry partners for joint programs and projects.

Career Options

Graduates of the Bachelor of Science with Major in Mathematics and Finance can pursue a variety of career paths in Canada, including:

- Actuary: Professionals who analyze financial risks using mathematics, statistics, and financial theory.

- Financial Advisor: Experts who provide guidance on investments, estate planning, and other financial decisions.

- Market Research Analyst: Specialists who study market conditions to examine potential sales of a product or service.

- Risk Analyst: Individuals who assess financial risks and develop strategies to mitigate them.

- Investment Advisor: Professionals who help clients make informed investment decisions based on their financial goals.

These roles highlight the diverse opportunities available to graduates, allowing them to make significant contributions in various sectors of the economy.

DISCLAIMER: The information above is subject to change. For the latest updates, please contact LOA Portal's advisors.

Visit University of Alberta official website